are funeral expenses tax deductible in california

No never can funeral expenses be claimed on taxes as a deduction. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents

This means that you cannot deduct the cost of a funeral from your individual tax returns.

. Estates however are able to deduct funeral costs from taxes. Medical and dental expenses. Can funeral expenses be deducted Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Funeral Costs Paid by the Estate Are Tax Deductible. Funeral expenses are not tax-deductible.

According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. This means that you cannot deduct the cost of a funeral from your individual tax returns. The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

Expenses that exceed 75 of your federal AGI. Are funeral expenses tax-deductible - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Expenses that exceed 75 of your federal AGI.

As such individuals cannot claim funeral expenses on their income tax returns and funeral expenses cannot be itemized or deducted on the decedents final tax return. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. On home purchases up to 750000.

In other words funeral expenses are tax deductible if they are covered by an estate. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

Deduction CA allowable amount Federal allowable amount. Determining if Funeral Expenses Can be Tax Deductible. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes.

These are personal expenses and cannot be deducted. The IRS deducts qualified medical expenses. For Miscellaneous Itemized Deductions subject to a 2 floor which includes job-related expenses anything that was deductible on a California return last year is still deductible.

As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductibleFor most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form. Can I deduct funeral expenses probate fees or fees to administer the estate. They are never deductible if they are paid by an individual taxpayer.

You cant take the deductions. Not all estates are large enough to qualify to be taxed. The taxes are not deductible as an individual only as an estate.

If the deceaseds state is taxable then executors are able to recoup some. This cost is only tax-deductible when paid for by an estate. They did not vote to conform.

Any individual even the ones who personally paid out-of-pocket will not be able to claim funeral expenses on his or her taxes. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. In short these expenses are not eligible to be claimed on a 1040 tax form.

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Qualified medical expenses must be used to prevent or treat a medical illness or condition. This is only applicable to estates that pay taxes and in order for an estate to be required to pay taxes it must have a minimum gross value of 1158 million.

California does not conform to any federal tax law unless state lawmakers vote to conform. On home purchases up to 1000000. Job Expenses and Certain Miscellaneous Itemized Deductions.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Per the IRS Miscellaneous Deductions guide Burial or funeral expenses including the cost of a cemetery lot are nondeductible. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate.

While the IRS allows deductions for medical expenses funeral costs are not included. Submitting the obituary and unallocated overhead which includes taxes insurance advertising and other business expenses. Deductible medical expenses may include but are not limited to the following.

The funeral establishment may require you to pay this fee in addition to the specific funeral goods and services you select. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs. Qualified medical expenses include.

So a 25 souvenir death DVD would no longer cost 25 but 2706. Individual taxpayers cannot deduct funeral expenses on their tax return. Even the most humble of funerals can come with hefty price tags.

In fact many people find it difficult to cover the cost of a funeral without experiencing at least a minor financial hardship. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. Funeral expenses are not tax deductible because they are not qualified medical expenses.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. The state gets to collect sales tax on such personal property. But this isnt applicable to every estate.

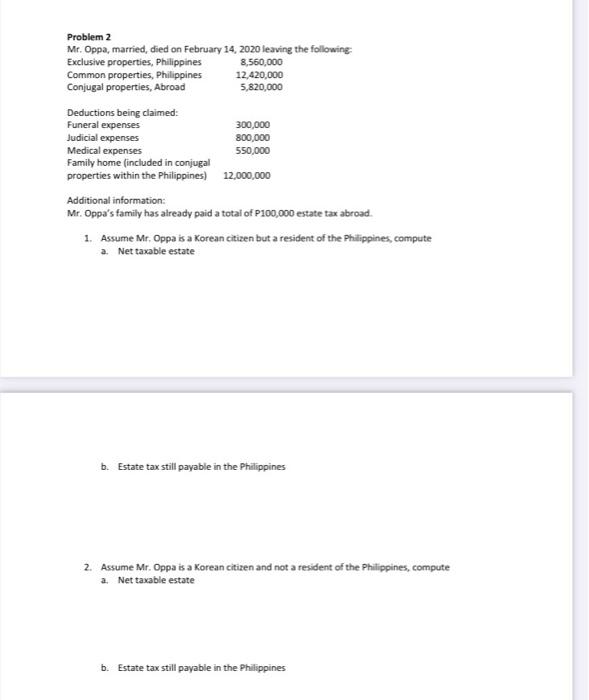

Problem 2 Mr Oppa Married Died On February 14 Chegg Com

Are Funeral Expenses Tax Deductible

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

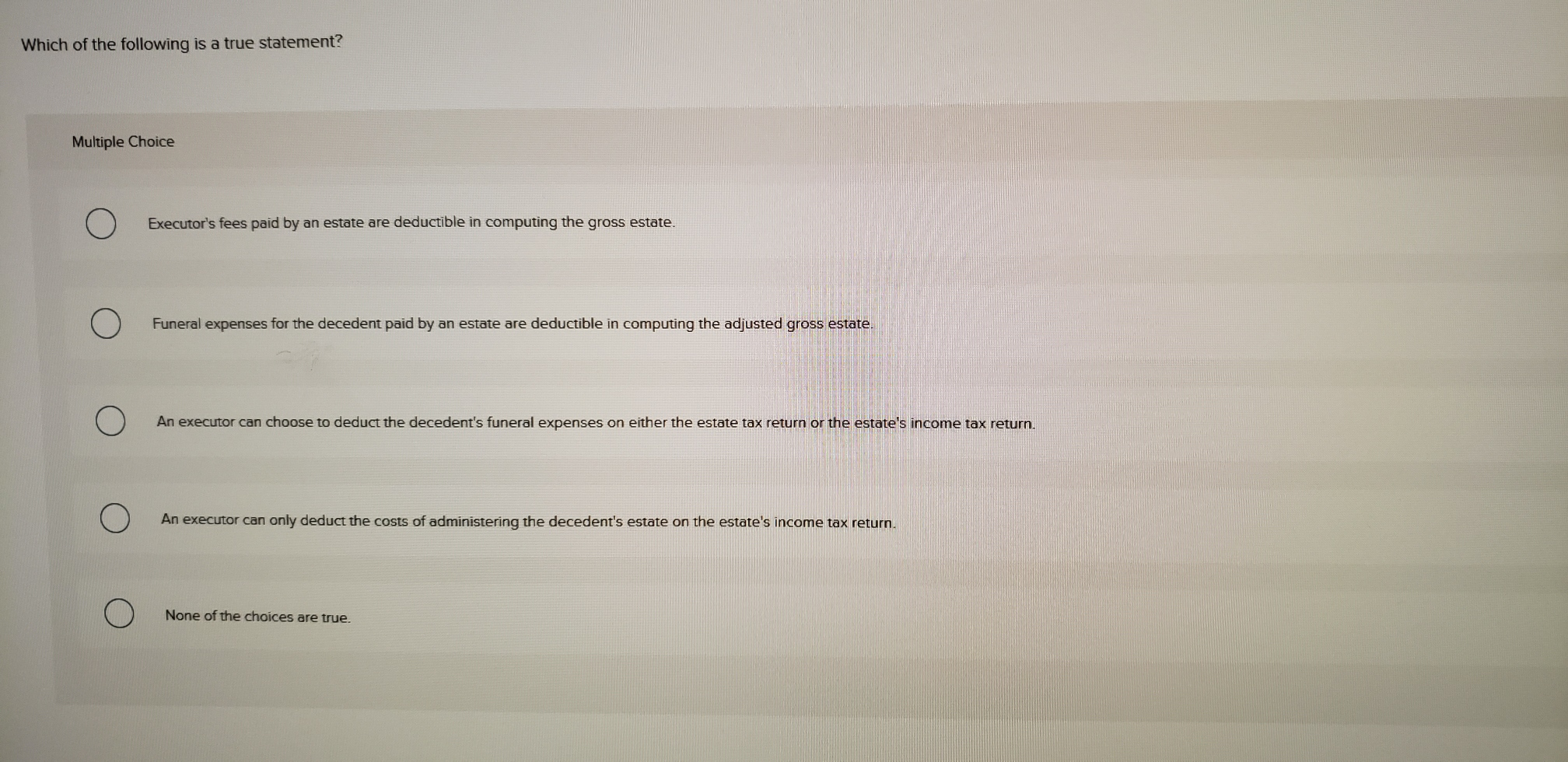

Solved Which Of The Following Is A True Statement Multiple Chegg Com

Are Funeral Expenses Tax Deductible

Are Medical Expenses Tax Deductible Community Tax

Are Funeral Expenses Tax Deductible Funeralocity

Table Of Contents California Society Of Cpas

Can I Deduct Funeral Expenses From My Income Taxes Debt Com

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Are Funeral Expenses Tax Deductible

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos